Real Estate Reno Nv Things To Know Before You Buy

Wiki Article

3 Simple Techniques For Real Estate Reno Nv

Table of ContentsThe 3-Minute Rule for Real Estate Reno NvHow Real Estate Reno Nv can Save You Time, Stress, and Money.Get This Report about Real Estate Reno NvReal Estate Reno Nv Fundamentals ExplainedThe Ultimate Guide To Real Estate Reno NvGetting My Real Estate Reno Nv To Work

The advantages of purchasing property are many (Real Estate Reno NV). With appropriate assets, investors can delight in foreseeable capital, superb returns, tax advantages, and diversificationand it's possible to take advantage of genuine estate to construct riches. Considering buying property? Below's what you need to find out about property benefits and why actual estate is considered a great financial investment.

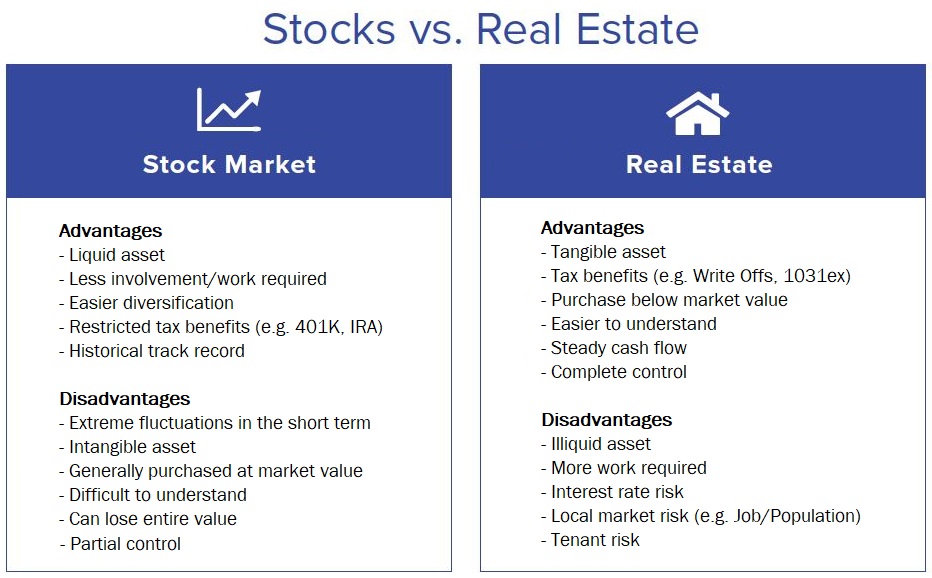

The advantages of investing in realty consist of passive income, stable cash flow, tax obligation benefits, diversity, and take advantage of. Property investment company (REITs) provide a way to buy property without having to have, operate, or financing residential properties. Capital is the take-home pay from a genuine estate financial investment after home loan payments and general expenses have actually been made.

Genuine estate values often tend to raise over time, and with a good financial investment, you can transform a profit when it's time to sell. As you pay down a residential property mortgage, you develop equityan possession that's part of your net worth. And as you develop equity, you have the take advantage of to get even more residential properties and enhance cash circulation and riches even extra.

Realty has a lowand sometimes negativecorrelation with various other major possession classes. This means the enhancement of property to a profile of diversified assets can reduce profile volatility and supply a higher return per system of risk. Leverage is making use of various economic tools or borrowed resources (e.

Some Known Details About Real Estate Reno Nv

As economies broaden, the need for real estate drives rents greater. This, consequently, converts into greater resources values. As a result, real estate has a tendency to maintain the purchasing power of resources by passing a few of the inflationary pressure on to occupants and by including a few of the inflationary stress in the kind of resources recognition.

There are numerous ways that having realty can protect against rising cost of living. Building values might increase higher than the rate of inflation, leading to resources gains. Second, rents on financial investment properties can go to the website raise to stay on par with rising cost of living. Buildings financed with a fixed-rate finance will see the family member quantity of the regular monthly mortgage payments fall over time-- for circumstances $1,000 a month as a set settlement will certainly come to be less look at this web-site challenging as rising cost of living erodes the acquiring power of that $1,000.

Despite all the benefits of investing in actual estate, there are disadvantages. One of the major ones is the absence of liquidity (or the relative problem in transforming an asset right into cash and cash into a possession).

The Of Real Estate Reno Nv

Yet among the easiest and most typical techniques is simply acquiring a home to rent to others. So why invest in realty? It needs a lot more job than simply clicking a couple of switches to invest in a common fund or stock. The truth is, there are many genuine estate benefits that make it such a popular selection for skilled capitalists.

Equity is the worth you have in a building. Over time, regular repayments will eventually leave you having a property totally free and clear.

The 10-Minute Rule for Real Estate Reno Nv

Anyone that's gone shopping or loaded their container just recently comprehends just how inflation can damage the power of hard-earned cash money. Among the most underrated realty benefits try here is that, unlike lots of typical investments, genuine estate worth often tends to go up, also during times of significant inflation. Like other crucial properties, real estate usually keeps worth and can therefore work as a superb location to spend while higher rates consume away the gains of different other investments you might have.Appreciation refers to money made when the overall worth of a property rises in between the moment you buy it and the moment you sell it. Genuine estate, this can imply significant gains because of the normally high prices of the properties. Nevertheless, it's essential to bear in mind gratitude is a single point and just gives money when you market, not along the road.

As stated previously, capital is the cash that comes on a month-to-month or annual basis as an outcome of having the building. Normally, this is what's left over after paying all the necessary costs like home loan payments, repair work, taxes, and insurance coverage. Some residential or commercial properties may have a considerable cash flow, while others may have little or none.

All about Real Estate Reno Nv

New financiers may not really comprehend the power of leverage, yet those that do open the possibility for huge gains on their investments. Usually speaking, utilize in investing comes when you can own or regulate a larger amount of assets than you could or else spend for, via making use of credit history.Report this wiki page